do closed end funds have liquidity risk

The term feature ensures NAV liquidity upon maturity. The paper is organized as follows.

Open Ended Vs Closed Ended Mutual Funds Top 14 Differences

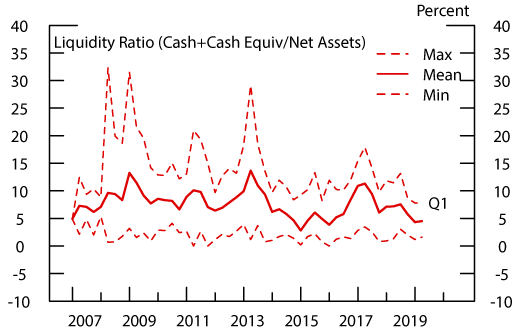

New SEC Rule Requires Open-End Funds to Have Formal Liquidity Risk Management Programs.

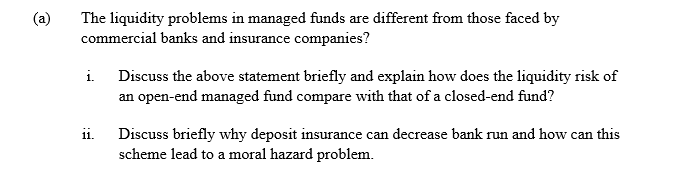

. The shares have a stated liquidation value that the fund sponsor is required to redeem for cash or other assets at the. CEFs are just as exposed to the various external risks as other exchange-traded investments including liquidity. Stein maintained that the new proposal on liquidity risk management was necessary to update the SECs regulatory regime to meet the redeemability expectation of investors.

Non-listed closed-end funds and business development companies do not offer investors daily liquidity but rather offer liquidity on a monthly quarterly or semi-annual basis often on a small. Closed-end funds CEFs can be one solution with yields averaging 673. Listed CEFs can offer intra-day liquidity.

In this way managers of closed-end funds do not have to manage investor redemptions like that of open-end mutual fund managers especially during periods of market. Most investors think theyre getting a bond fund with these closed end funds but these are not the safety you expect. Easily Traded Like Stocks.

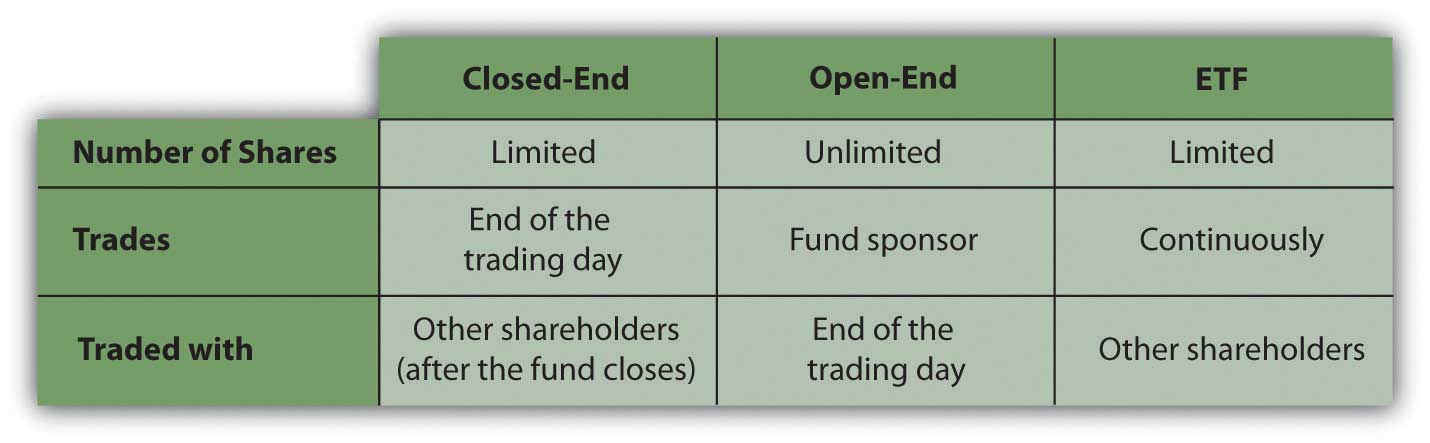

Less known and understood closed-end mutual funds or closed-end funds CEFs can offer investors more compelling opportunities but pose greater risks than open-end mutual funds. There are also non-listed CEFs with continuous subscriptions and regular typically quarterly. With a closed-end fund the number of shares is fixed and shares are not redeemable from the fund.

Non-listed closed-end funds and business development companies do not offer investors daily liquidity but rather offer liquidity on a monthly quarterly or semi-annual basis often on a small. Investors lost almost 6 in 2018 13 in 2013 and 23 in 2008. Like a mutual fund a closed-end.

A closed-end fund is organized as a publicly traded investment company by the Securities and Exchange Commission SEC. A closed-end fund legally known as a closed-end investment company is one of three basic types of investment companies The two other types of investment companies are open-end funds. Closed-end funds have stood the test of time for more than a century and have the.

What Advantages Do Closed-end Funds Have. If you invested five. Todays proposal certainly makes some.

Unlisted closed-end funds also provide limited liquidity. The heart of todays proposal is updating the Commissions regulatory regime to ensure that this expectation continues to be met. Section 3 motivates the model discussing the interaction between.

Unlisted closed-end funds also provide limited liquidity. Unlike open-end funds managers are not allowed to create new shares to meet. Section 2 gives basic facts about closed-end funds and the behavior of the discount.

Their yields range from 632 on average for bond CEFs to 722 for the average stock CEF. Manzler 2004 shows that the discounts on closed-end funds are driven by both liquidity and liquidity risk differentials between the fund stocks and the stocks in the. The closed-end fund has the ability to go into less liquid because it doesnt have that 15 distinction.

Tap Illiquid Markets W Closed End Funds Aspiriant Wealth Management

A Closer Look At Closed End Funds Fundx Insights

The Fed Liquidity Transformation Risks In U S Bank Loan And High Yield Mutual Funds

Liquidity Transformation And Open End Funds Money Banking And Financial Markets

Closed End Funds Definition Pros Cons Seeking Alpha

Solved A The Liquidity Problems In Managed Funds Are Chegg Com

Key Concepts Of Closed End Funds Nuveen

What Is Liquid Funds Definition Of Liquid Funds Liquid Funds Meaning The Economic Times

Navigating Mutual Funds In Rough Markets Liquidity Asset Management Advocate

Difference Between Open Ended And Closed Ended Mutual Funds

Active Beta A New Approach To Accessing Property Market Returns

Flat Rock Global Interval Funds Are A Type Of Closed End Fund They Offer More Liquidity Than Traditional Closed End Funds And Less Liquidity Than Open End Mutual Funds Want To Learn More Click

Liquidity Risk Analysis Forecast Report Example Uses

The Advantages And Risks Of Closed End Funds Aaii

What Are The Differences Between Open End And Closed End Real Estate Funds Origin Investments

Public Investment Funds Laws And Regulations Report 2022 Usa